👱♀️Pelosi in Taiwan

📉Oil tumbles again

🤨Recession? No Recession? Recession???

Up and down.. VIX shoots up📈

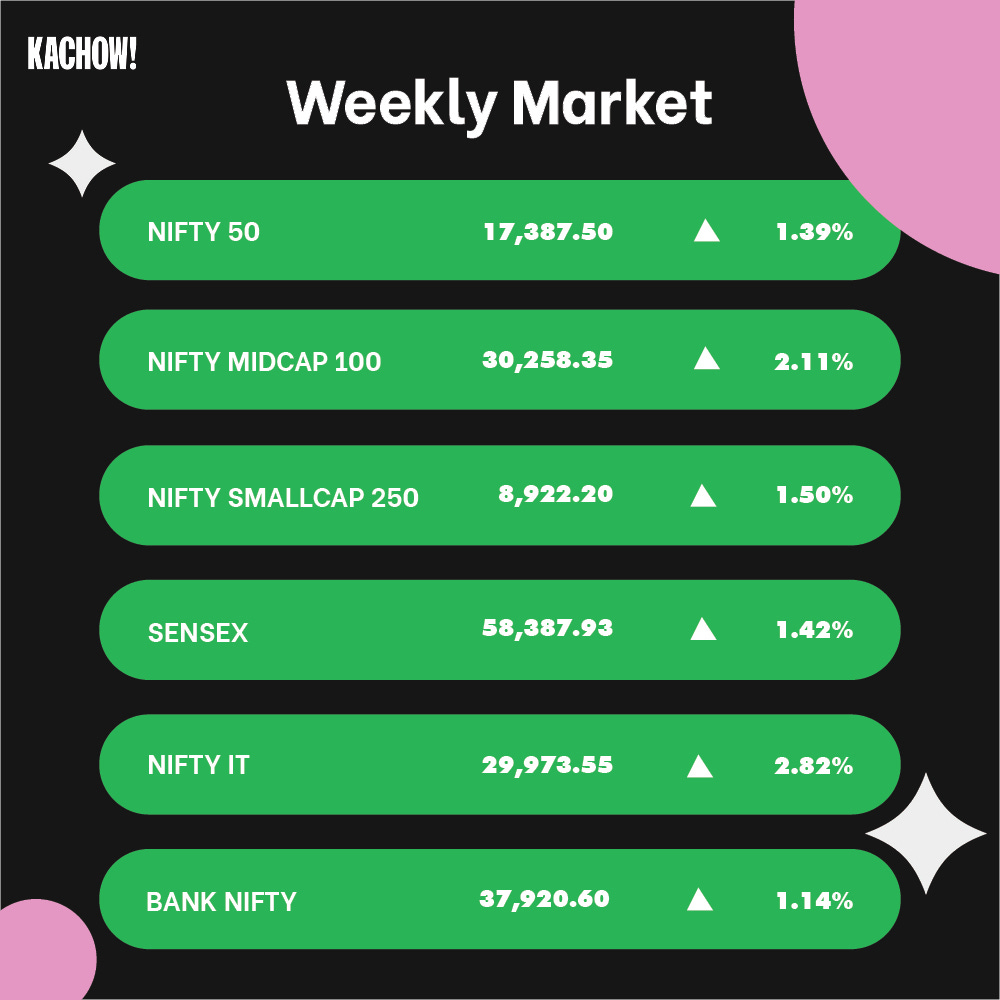

India VIX🆙14.3% during the week, as tensions mount in China-Taiwan (more on that in the section below). Nifty50 made big intraday moves throughout the week, however, the index ended up 1.4%. Midcaps and Smallcaps moved as corporate earnings continued to surprise on the upside😲

Germany's gas shortage has some positive news for India, as global companies like BASF (chemicals), Heinz Glass (glass) and Smurfit Kappa (paper) are expected to cut production. Positive for Indian cos - glass manufacturers/fertiliser/chemical producers like GNFC / paper packaging like JK Paper and West Coast Paper

Some of the biggest movers this week👇

Large Cap - M&M, Adani Ports, JSW Steel, Cipla

Mid Cap - JSW Energy, Varun Beverages, IDFC First, Manappuram Finance

Small Cap - SREI Infra Finance, IRB Infra, Inox Wind, Redington India

BoE raised interest rates by 50 bps. Policymakers are expecting a recession in the next 5 quarters. Also, construction companies in UK recorded their biggest fall in activity in more than 2 years. Caution with companies having European exposure. Brazil also raised repo rates by 50 bps💪

Indian corporate earnings glimpse...

✅Positive results from Nazara Tech, Chola Fin, Metro Brand, Sun Pharma, Zomato, Alkyl Amine, UPL, ITC, Lemon Tree, Deepak Nitrite, INDIGO, PI Ind, Gujarat Gas, Devyani Int, GAIL, GSPL, CONCOR, BEML, JB Chem, Dabur

🔴Negative from IOC, CIPLA, Ashok Leyland, Dhanuka Agritech, Indus Tower, LIC Housing, Britannia

Notable results coming from Zomato and ITC this week. Zomato reported strong operational numbers. Food delivery segment became breakeven on segmental basis with unallocable costs now making almost entirely the EBITDA loss. With the current pace and strong MTUs, Zomato could turn profitable sooner than expected. ITC beat street est on all fronts. Strong revenue growth led especially by Agri (up 83% YoY). Cigarette volumes in line with est.

Metro Brand, INDIGO and Nazara Tech

Stellar results by Metro Brands led by higher realizations and improved product mix. EBITDA at INR 180 cr grew 41% QoQ with highest ever margins of 36%. INDIGO missed PAT estimates due to FX losses but operationally had one of the best quarters. Highest ever quarterly revenue of INR 13K cr. Stock up 11% in the week. NAZARA made big moves this week led by very strong performance driven by Esports and Datawrkz integration. Stock up 12% during the week.

For real-time insights, download Kachow! app

Around the world in 3 mins

Pelosi in Taiwan

From our mid-week newsletter

The US House Speaker became the first highest-ranking US official to visit Taiwan in 25 years and yes, China is furious. Won't dig much deeper into the issue here, but in short, China views Taiwan as a part of its territory and any visit by foreign government official is basically viewed as acknowledging Taiwan's sovereignty. Well, in this case, its Nancy Pelosi👱♀️😶

If you want to know more, read this and this, two articles that give a much deeper view into the China-Taiwan issue.

So, yes, coming back to the point... WTH should we be worried??🤨

Two blatant reasons "S's" that stare into our faces

➡️Semiconductor

➡️Supply-chain

From your phones to laptops to watches to game consoles to automobiles - computer chips are required and Taiwan dominates the global production of computer chips (65% market share).

Then comes, World Trade. Any kind of tension will be a tail risk to one of the biggest shipping lanes in the world. According to Bloomberg, almost half of the global container fleet and a whopping 88% of the world’s largest ships by tonnage passed through the Taiwan Strait this year. Logistical bottlenecks will come haunting again

So, now Chinese authorities have announced planned live-fire military drills encircling Taiwan. And with that, import of fruit and fish from Taiwan and shipments of sand (crucial raw material for Semiconductors) to the island have been halted… Tensions mount🙃

From 650 kb/d to 100 kb/d😶

OPEC+ surprised markets with only a 100 kb/d increase in September, far less than ~650 kb/d agreed to add in July and August. Arguably, it's meaningless. If this was a few months back, oil would be up 5-10% on the news. But oil cracked!! Post this news, Brent made a low of $93.2 yesterday (pre-Russia-Ukraine war levels) and is down ~14% this week👎

Why? What happened?🤔

➡️ US Gasoline inventory buildup

➡️ Demand concerns from China

While US gasoline buildup isn't new, it is surprising during the summer driving season. Crude stocks rose 4.5 mb/d last week, against expectations of draw of 600 kb/d , while gasoline stocks gained 200 kb/d vs expectations for a 1.6 mb/d drop. Exports have fallen and refiners lowered runs.

On the other hand, manufacturing and property sales, two key data points from China continued to weaken. The manufacturing PMI surprised markets by contracting in July to 49.0 while sales at the country’s top 100 property developers fell sharply by 39.7% YoY in July. China has seen a widespread mortgage revolt (we've highlighted in our early newsletter)

Though OPEC members have between 2-2.7 mb/d in spare capacity, it will be tapped only when Saudi sees a crisis during winter months. It's in a wait-and-watch mode!

While US didn't call out a recession even after 2Q GDP figures, the world seems to be in a slowdown mode...😑

R-word😵💫

So, as highlighted above, US didn't call out for a recession, despite 2 quarters of negative GDP growth. But data points suggest a weaker macro environment developing globally.

Global semiconductor sales have decelerated for 6 straight months, rising just 13.3% YoY in June, down from 18% growth in May. The slowdown is the longest since the US-China Trade war in 2018📈

A Bloomberg Economics global tracker shows the prospects for the world economy have deteriorated rapidly this year, coinciding with chip sales beginning to slow.

Chip exports from South Korea eased to 2.1% YoY in July from 10.7% in June. Same story in Taiwan and now China has halted exports of sand to Taiwan which is a key raw material for production.

Foreign outflows continue out of emerging markets. EMs reported the longest period of net outflows since 2005, highlighting the recession risks.

While India's manufacturing PMIs are strong, China activity is showing signs of slowing down. 2nd half of the year is going to be crucial. Europe gas prices still remain volatile, OPEC+ spare capacity might not fill the supply gaps and then comes winter🥶

So recession or not... data points are not rosy anymore!🙃

This week in Numbers

1

Liverpool is just one EPL title away to match Manchester United's record of most premier league titles (can they do it this time?)

$22 billion

India's top 3 telcos are expected to spend over the next 5 years rolling out 5G services

$1.286 billion

The amount winner got in the Mega Millions lottery. Third highest sum won in history

Take a Kachow! break

(What we read, heard, and saw this week)

Trung Phan's twitter thread on Mona Lisa read more

Ferrari Rides Formula 1 Success To Record Sales read more

MBS: despot in the desert read more

The future of global retail will be local read more

Breaking Points read more

The Louisiana Purchase listen more